I received this fascinating and long letter in response to a comment I made on this blog about debt, and my objecting to it. This fellow is a professional economist, so his words should count. His letter is in black typeface, my responses to him are in red.

Chuck-

I have admired your designs casually for many years, but following your blog

and reading your book recently, I encountered a closer parallel between our

lives and sentiments. Born in 1942, I, too, grew up (in New York) loving

boats. I drew them, sketched designs, visited boat shows, collected old

Rudder and Yachting magazines, and assembled a large library of books on

history, design, building, cruising, and art that is still growing. As a

teen-ager, I even contemplated a career as a yacht designer, once visiting

Henry M. Devereux at Minneford’s. He gave me a piece of drafting vellum,

which I kept for many years and may have yet, though sunk in clutter. My

father was persuaded to buy an old Hampton One-Design (sort of between a

Comet and a Lightning) for my younger brother and me, and we sailed it out

of City Island for several years. There was never enough time for sailing,

but the most important lack was time for maintenance and refinishing.

Dear Peter,

What fun it was to get your long and erudite letter. You were an amateur yacht designer and a professional economist- I am that far more dangerous of breeds, an amateur economist and professional yacht designer. It is clear that we both love sailing, and we both share a concern when the intellectuals who guide our economy get it wrong, to the detriment of countless people around the world.

For fun, let me try to refute or illuminate your many cogent points, and in a way that hopefully will not confuse my blog readers’ understanding of which voice is yours and which mine. I’ll do this by putting your original letter in black typeface, and my own responses in red.

While you attended Brown, I went to Harvard, majoring in German literature.

Parenthetically, I just re-read Thomas Mann’s “Der Zauberberg,” in which the

hero is a young man who loved drawing boats and trained as a naval

architect! I did sail a bit with the Harvard Yacht Club and once met Olin

Stephens. I still remember asking him whether there was a boat type that he

would like to design without regard for a rating rule and his replying to

the effect that he could not conceive of one. Having graduated in 1964 and

abandoned the idea of applying to medical school, I joined the Peace Corps

(India, 1966-67). On returning. I trained as an economist at Yale, where

Janet Yellen, who was a year behind you at Brown, was my classmate. After

grad school, I crewed for a summer in the Shields class on Long Island Sound

but found a job with the federal government in Washington, where I spent my

career, primarily in regulatory economics. I have been widely noted

(admired?) for the drawings of boats with which I stave off boredom in

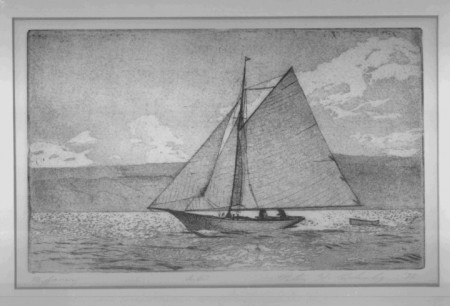

meetings. I did make etchings for a while and contemplate taking them up

again, though I could certainly improve my technique.

I found your sketches charming and artistic- indeed I wish I could recapture some of their naivete’ in my own work, which tends too far towards precision and realism. The final one in particular- the one of the cutter- was lovely in the extreme. I wonder what was your medium… a combination of pencil with watercolor washes? Its only failing, and it is extremely minor, is the slightly too high freeboard and incorrect placement of the mainsail battens. But the design of the clouds, values of the shoreline in the background, and drafting of the sail seams, and its general playfulness, could not be improved upon by anyone!

As you know I graduated from Brown in 1966- two years after you left Harvard. Although I studied engineering, during my senior year I met and fell in love with a graduate student in economics—her name was Frances Cairncross— I am sure you will have heard of her. It is she that my “Frances 26” was named after, and probably from her that I acquired my lifelong fascination with the dismal science.

Like you I also served in the Peace Corps—in Iran between 1969 and 1971, and got to India a few years later on a four-month overland backpacking tour with my then girlfriend- now my wife- in tow. It is sad to see how many countries which were once friendly to America and us to them—Iran, Afghanistan, Pakistan—are no longer welcoming, and to ponder why this has come to pass. You can blame it on one man if you prefer- like you a Yale Grad but unlike you an idiot (GWB, if you were wondering), but his follies are being happily taken up by his entire reactionary party, and our national and just possibly the world’s economy may well fail as a result.

In 1972, my wife and I bought an O’Day Mariner 2+2 in Washington and cruised

it down the Potomac and up the bay to Annapolis. That model was the most

handsome of the series-as you probably know, a Rhodes 19 hull with a

self-bailing cockpit and tiny cruising cabin with four (notional) berths.

Though it was fast, weatherly, and able, a centerboard sloop without a

steady helm still raises problems for single-handing, so I was always

dependant on my wife to crew. We kept it in a slip and enjoyed it for

several years, but the travel and preparation time was about equal to the

sailing. Even with fiberglass, we were never able to dismiss thoughts of

maintenance entirely, nor was the idea of trailering 1400 pounds simple

enough to widen our horizons. As they say, the second happiest day of a

sailor’s life… Facing retirement, I saw some advertisements for stunning

wooden cruising boats at modest prices and reached the painful conclusion

that what I couldn’t afford was not the monetary cost but the complete

change in lifestyle that owning a boat would demand of a city dweller. When

I dream now, the most attractive prospect is a decked sailing canoe,

something like Mik Storer’s Beth-garage storage to car top to water,

single-handed without a trailer or ramp. I may never reach that point,

either, but the stress of ambivalence is less.

You have no need to own a sailboat! Simply come to Maine anytime in the summer and you can come sailing on mine. If you read my essay “THE FUTURE OF YACHT OWNERSHIP” on my blog, you will see that one way we can save the earth is by learning to be content with the material possessions we already have, and sharing them. If we are to survive, we have to cease building more “goods” (nothing good about them, actually), and sharing the extant ones more equitably.

What prompted me to write, however, was not shared history or interests but

something you wrote on your blog recently: “Governments and Wall Street

expanded the money supply through massive borrowing against the well-being

of future generations…The economy has recovered a bit since then thanks to

massive money-printing, (our children will inevitably pay for this).” I

have learned that we share many values- concern for other peoples and future

generations and stewardship of the environment, besides a romantic

aestheticism. We both regard with skepticism (perhaps disdain) the

self-serving pomposities of financiers and their adherents who idolize

markets. What you may not realize is how antithetical your words are to

your own values and how strongly they reflect the prejudices of the right.

I am, though, far from right (politically, that is). I am a liberal and proud to call myself one! But when it comes to issues of sustainability, perhaps you are correct. I believe one generation (ours) has no right to live well at the expense of future generations. If this means Recession, or Austerity, or avoiding borrowing, then so be it. Homo Sapiens has stood erect upon this earth for 1000 generations. We have (we Northern Hemisphere Americans and Europeans), in the past four or five generations, extracted from the finite crust of our host planet a vast proportion of its remaining store of minerals such that the only argument, at present rates of consumption, (and once the Chinese and Indians begin to make their claim, that rate will ramp up exponentially) is whether we will have extracted it all within the next five at least, or ten at the most, generations! Is this fair to the remaining potentially 990 generations who will thereby live in abject penury or more likely not live at all? We—well actually YOU (economists)―have a duty to find a way to permit another 1000 generations to enjoy life on this planet. By espousing Capitalism, free markets, and Keynesian economics, I fear you are neglecting this duty!

Even when he thinks he is espousing the liberal cause, President Obama has

argued the need for economizing to protect our children and is only now (one

hopes) being weaned from a perverted model.

Obama is a great man, and a thinker. For which he is hated by some. I hope he will devote the remainder of his term to pulling the wool off our eyes and addressing the failings of Capitalism and the Free Market before it is too late.

What do I mean with this “too late” warning? Countless small countries in Africa and Latin America have progressed to the point where a few highly placed individuals possessed essentially all their nations’ wealth while the remainder of the population lived in abject poverty. And two great European empires reached the same disparity of wealth- France in 1789 and Russia in 1917. We too are dangerously close to this level at present and moving inexorably toward the tipping point. The result is invariably the same- violent revolution. If you think our unemployed masses or our marginally employed workers whose “minimum wage” is incapable of supporting them and their families at anything approaching the poverty level- are content with the present state of things, well, “Let them eat cake!”

If you, like Polonius, were offering advice to your son, you would be wise

to discourage him from frittering away his savings on unnecessary luxuries,

leaving himself and his children impoverished. Prudent saving and

investment would allow him to accumulate claims on the product of others,

who would support his family in comfort.

It is because of our shared values (concern for other peoples and future generations and stewardship of the environment, plus a romantic aestheticism) that I have come to abhor inflation and its bedmate, debt. It is for this reason that I wrote the words “The economy has recovered a bit since then thanks to massive money-printing, (our children will inevitably pay for this).” And I have indeed, like Polonius, discouraged my son from frittering away his savings on unnecessary luxuries. (For the benefit of my non- Shakespeare readers, Polonius’ advice to his son was, “Neither a borrower nor a lender be”).

There are two flaws with this prescription when applied to a nation’s economy. The first is the “fallacy of composition.” One man’s consumption is another’s income, so it is

impossible for a society to enrich itself by spending less.

Begging the question, should society’s job be to enrich itself? A question no present economist will ever utter. My answer is, no. The level of self-enrichment that America (and the rest of the Western World) went through before 2008 threatened to incinerate the earth, or at least to extract the remainder of its finite resources within the span of the next few generations- and then what?

What economists should be asking is, “What level of enrichment is SUSTAINABLE?” And at that level of consumption, how do we distribute the associated level of goods and services so that every person on earth can survive and enjoy life? Capitalism- the economists’ present darling- eponymously rewards capital, with the result that the rewards go to the owners of that capital, leaving non- capital owners impoverished. At the resultant rate of rapid wealth redistribution, a few families will live in opulent splendor and the remaining 99% of the population will starve to death. Yet, sir, has even one of your fellow Harvard professors ever questioned the idea of a new “ism” to replace Capitalism?

My idea of that “ism” might be named Conservism, though that sounds suspiciously like “Conservatism” which it is, actually, diametrically opposed to.

If everyone tries too hard to save, each will find himself losing wages or sales, and

the process will continue until growing poverty discourages saving.

If a farmer did not “save”, at least a few seeds from each crop, but consumed everything, then the next year he would starve. Saving is a necessity that permits life to go on. If he not only consumed all this year’s seeds, but the next year’s and the next, (long term debt) he would starve that much sooner. This is what we will do by trying to solve the pre- 2008 mistake of incurring too much debt- both public and private- by massively increasing debt! You don’t put out a fire by adding more fire.

Claims against others are meaningless, when what counts is aggregate productivity.

I’m all for aggregate productivity, as long as it is sustainable. If productivity means mining irreplaceable resources, then it can last just so long. If it means producing capital (think wind-turbines) that can be productive forever without harming future generations, then “bring it on!”

The second flaw is assuming that spending less on one thing automatically

frees resources that will be employed elsewhere, possibly on something more

desirable. What recessions prove is that unemployment is not a transitory

phenomenon, that new demand does not appear magically to offset the collapse

of a market sector.

I totally agree! The “Great Recession” is at least partially the result of a failure of aggregate demand. (Am I right?) But printing more money (oops! Let’s call it QE) has had until this point little to no beneficial effect upon aggregate demand and therefore employment. A good metaphor this time is that it’s like pushing on a rope. If there’s nobody pulling, there’s no effect. You see, the populace is ahead of the economists. We all KNOW that we cannot continue to consume- that this would be a worldwide end-game. So no matter how much money you print (sic), we ain’t buying. Offer us Infrastructure, sustainable energy production, efficient provision of health care, removing subsidies to inefficient production, and throw in aid to the starveling nations of the Southern Hemisphere, and we’ll buy.

But the unemployment problem this go-round is more than simply a lack of aggregate demand. An essential consequence of Capitalism is that massive intellectual effort has been devoted for generations to replacing workers with machines or rather, labor with capital. Although plenty of “work” has been provided to the designers and manufacturers of the ATMs that have replaced bank tellers, Self-Checkout machines that will replace cashiers, People-movers that require no conductors, and on and on and on, (they’re working on airplanes that will take off and land themselves!) the result of this aspect of Capitalism will ultimately be a world of robots, computers and machines, and no need for human work. Of course this is entirely sustainable and stable if the rewards that derive from this Capital were equitably distributed in such a way that every human received a sufficient share of the reward (profit) to sustain himself and his family. But Capitalism as presently contrived distributes these rewards only to a minute fraction of the world’s population, and the ones who need it least- the wealthy. This is clearly unsustainable and unstable.

Although “money printing” is a misleading term for the Federal Reserve’s policy, (my bad, I meant QE- Chuck) what it is trying to do is to reverse the wholly destructive effects of reductions in federal, state, and local spending by lowering the cost of private borrowing to spend and invest. (All laudable in my view.) Unfortunately, this monetary policy is a crude mechanism that has been able to stave off disaster (Congrats, President O. and Mr. Bernanke!) but has not compensated for the long-term waste of unemployed labor, industrial capacity, and other resources caused by cuts in both private and public spending. No, we agree, it has not. And it won’t. Only by moving the ownership of capital somehow from private to public hands thereby disbursing its rewards equitably, and increasing investment in sustainable means of production (Infrastructure, sustainable energy production, efficient provision of health care, removing subsidies to inefficient production etc.) will we stave off ultimate disaster.

When we talk of saving to improve the welfare of our children, we are not

referring to a survivalist’s investment in canned food, nor will money,

stocks, and bonds do more than apportion claims under a system of law and

taxation that may be altered to reassign them later. Material benefits will

be derived from investment in roads, transit, power grids,

telecommunications, buildings, factories, and other durable infrastructure.

Here we absolutely and totally agree! And what is our government doing? Cutting all of these investments!

Protection of the environment, whether included in these investments or in

separate programs, will be a cost that should be shared fairly,

independently of market outcomes. So true! In each case, a strong argument can be

made that only government has the necessary information, power, financial

resources, and long-term perspective. When will half of our voters begin to understand this?)

Even if these qualities are not always apparent, there is less evidence for the often-asserted superiority of private judgments. Public investments, however, though the most valuable and necessary in the long run, are just those that have been severely cut by misguided policies. Even more important for future welfare is human

capital, including everything from universal health maintenance to

libraries, schools, and mass education to museums, cultural institutions,

training and research at the highest levels. Again, market outcomes will

never provide enough of these; only collective decisions and public spending

will do.

I’ve lived in Europe long enough to know the truth of this. It’s called Socialism, and it works exceedingly well! The fact that it’s a dirty word over here may spell our competitive demise.

Whether such public spending should be supported by (higher) taxes,

balancing the government’s budget, is an empirical, not a moral, question.

It should, because the only alternative is debt- a euphemism for my eating the cheeseburger and giving the bill to my grandson.

To the extent that full employment and personal freedom necessitate

maintaining a certain private ability to consume, the rates and forms of

taxes may be limited, but beyond that, government’s command of resources is

constrained only by the labor and material not otherwise employed. The

decision, whether to finance any desired level of government spending by

confiscating private wealth through taxes or by borrowing, maintaining

private wealth (in the form of Treasury bonds) intact is a purely technical

question that should be evaluated by its ability to keep the economy

functioning efficiently. There is nothing about governmental borrowing that

is immoral, dangerous, wasteful, or improvident. It is if it causes inflation! The argument that a country running large deficits or expanding the money supply risks high

interest costs or runaway inflation has been dramatically contradicted by

all recent evidence.

ALL? Only once in history has there not been a direct correlation between running large deficits and inflation, and that is in the current Great Recession. And that is because of the pushing on a rope phenomenon, which has emerged for the first time in economic history. In remembering all that I’ve seen of recessions and booms throughout my life, each time a recession came along I said, “This time it’s different.” And every time I said this, I was wrong. Keynesian economics always worked (If you print it, they will spend). But let me humbly suggest, because we are transitioning from a time when the endgame of depleted resources loomed so far over the horizon as to be invisible, to a time when Everyman knows he’s gotta stop consuming or the game is over, that…This Time It Is Different!

That the wealthy love tight money policies which harm

their poorer debtors is, itself, a reason to regard them with suspicion.

Unemployment, poor health and education, worn-out capital, and a degraded

environment are the only legacies we can leave that will burden our

children. Massive borrowing is not against the well-being of future

generations: under present conditions, it may be their only salvation.

There has got to be a better way. And this time, it won’t work! It simply pushes harder on that rope.

Well, enough of my tirade. (Actually I can’t get enough of it) I enjoy enormously what you write, and I believe we look at boats in similar ways. They are objects of beauty that we want

to possess, and they afford a unique experience and training that can become

a lifetime’s avocation. At the same time, it is easy to be tempted by the

fantasy into unrealistic decisions-either because one can’t afford the

monetary cost or because making room in one’s life for sailing may displace

too many other pleasures and obligations. I agree that the future is likely

to call forth opportunities for new forms of boat sharing that permit more

intensive use, though most will unfortunately represent the lowest common

denominator of mass appeal. Perhaps institutions like the Center for

Wooden Boats in Seattle (where I once sailed a Beetle Cat and a Herreshoff

12 ½) could be expanded and diversified. “Sail Newport” which is a boat-sharing enterprise in Newport RI is prospering- there will be many others) You have had an amazingly successful career, doing what you love and doing it so well that you have

both supported yourself and brought joy to others, even those who only read

an occasional article or admire a set of plans. I do hope that what I have

written will prompt you to reconsider some of your interpretations of the

state of our society. There are many economists who can explain these

issues with much greater competence than mine and, unfortunately, many

highly respected ones who are venal or perversely ignorant.

Best Regards,

Peter Belenky

Summoning up what little I retained from Economics 101 plus a lifetime of reading has been fun for me. As will be reading your reactions to my layman’s view of what we’re going through right now. Remembering always that it was GWB’s ideological cretinism that got us into this mess in the first place, I sincerely hope that this latest multi-trillion dollar dose of Keynesian economics actually saves the sinking ship. But I fear, This Time It’s Different. -Chuck